News & Insights

Will Meta-Fi Be the Catalyst of Financial Digitization? - Part 2

Onur Küçük | MANAGING PARTNER

14.10.2022In our previous article, we have included information about the value of cryptocurrencies in the metaverse within the framework of the financial metaverse and the transactions that constitute the subject of the financial metaverse. Now, from the perspective of the financial metaverse, we will discuss the banking sector, the current status of cryptocurrencies in Turkey, and whether the digital products obtained as a result of financial transactions can be evaluated within the scope of property rights by the courts, the compliance processes and legal aspects that should be considered in Meta-Fi.

Banking Sector

The year 2022 continues to change the trends in banking with the digitalization movement. Metaverse brings innovations in banking with artificial intelligence, personalized financial advice, and digital transformation. Especially with the development of the game industry, in-game purchases seem to have increased considerably. Players buy clothes and necessary items for their avatars that reflect their character. So much so that young players who do not have a credit card can make their purchases through virtual cards. It will be possible for young players who have created their avatars, for now, to sell their avatars to different players with NFT in the future.

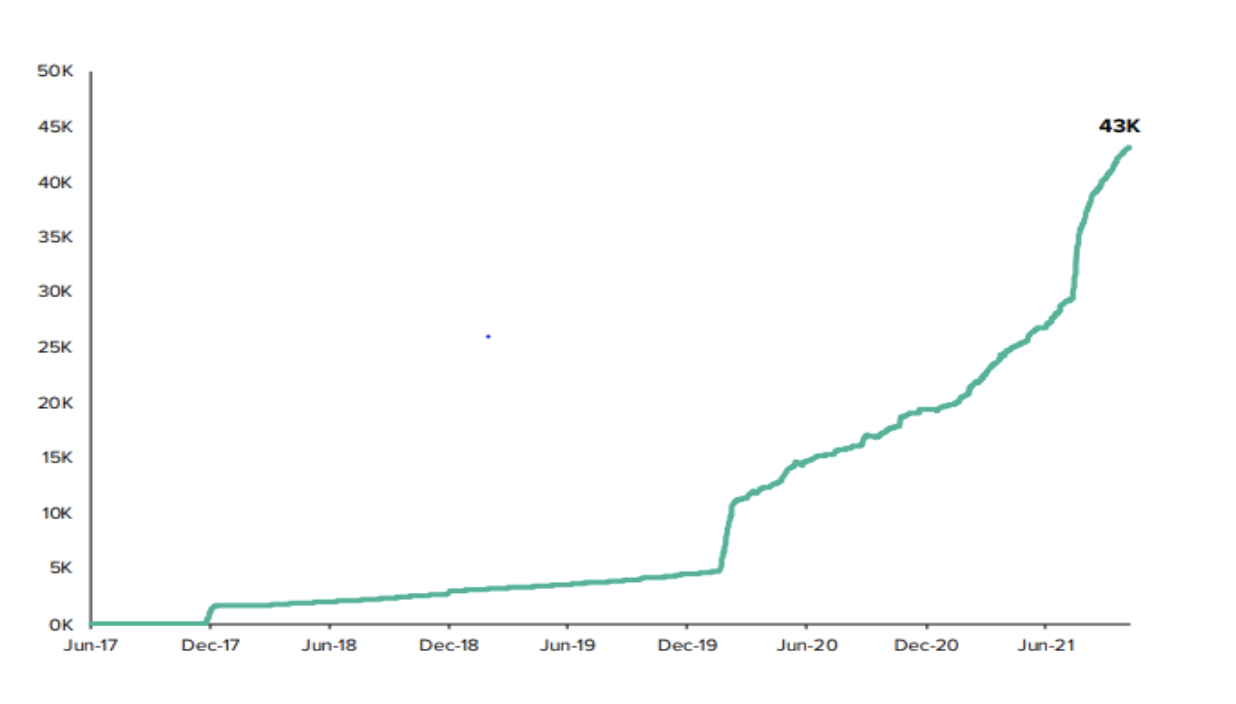

According to the Metaverse: Web 3.0 cloud economies report, the number of metaverse wallets increased 10 times between June 2020-2021. Fintech institutions and banks also took action by not being indifferent to these developments. To give an example, Garanti BBVA Portfolio in Turkey established the “Garanti Portfolio Metaverse and New Technologies Variable Fund” (MET). Investments can be made in this fund through Garanti BBVA branches and digital channels. Those who have an account in another bank also have the opportunity to invest through TEFAS without a lower limit. Aktif Bank bought a large area from Decentraland consisting of virtual lands and started design works. Various organizations and events will be held in this area with Passo, a sports and entertainment platform. In addition, Türkiye İş Bankası was the first bank from our country to advertise on Roblox, a global online gaming platform with more than 200 million users worldwide. Players will see the advertisements for İşbank's Maximum Gaming credit card on the billboards in the relevant parts of the game in the metaverse. Akbank Art stated that it is working on opening the exhibitions in the metaverse in connection with NFT, and Akbank hosts the 'Now in Digital Art: Alternative Realities + NFT' Exhibition.

Metaverse Wallet Usage Graph, Grayscale

It is noteworthy that collateralized loans according to the value of NFTs are quite popular. It also provides a 'Metaverse mortgage' to purchase virtual land. JPMorgan, one of the largest American banks, announced that it has officially opened an office on its blockchain-based metaverse platform Decentraland. JPMorgan, with its office called Onyx Lounge, stated in its whitepaper that it has taken place in the virtual universe to meet the needs of its users such as leasing, mortgage transactions, and loan use.

Meta-Fi, Cryptocurrencies and Legal Dimension

Cryptocurrencies and digital assets will be more and more important in the future. Countries are preparing the basis of their regulations based on the understanding that cryptocurrencies can be used as a means of payment. As it is known, the Central American country El Salvador was the first country to accept Bitcoin as a legal payment instrument. Positive developments regarding cryptocurrencies stand out in Lugano, Switzerland. According to the new regulation, citizens will be able to purchase products and services and pay taxes via Bitcoin and Tether (USDT). In addition, the local crypto-asset LVGA pegged in Swiss francs can also be used as a means of payment.

If we look at whether NFTs can be evaluated within the scope of property rights and beyond that, the judicial decisions that affect their relationship with finance; We can give the first example from Singapore. The Singapore Court applied an injunction to prevent the sale of an NFT used as loan collateral after the dispute between the parties. The BAYC #2162 NFT was marked as "suspicious activity" by OpenSea, the world's largest NFT marketplace, making it impossible for the current owner to sell the NFT, while buyers were unable to bid. In mid-April, the plaintiff borrowed money from an anonymous user named “chefpierre.eth” and in return offered his NFT as collateral. When the plaintiff could not pay the loan on the due date, the anonymous user took ownership of NFT, that is, NFT was transferred to his wallet. The plaintiff sued for unjust enrichment, claiming that his BAYC (Bored Ape Yacht Club) NFT was worth much more and that he only wanted to use the NFT as collateral for his loan and had no intention of selling his NFT. The court, on the other hand, gave an injunction to prevent the sale of NFT until the dispute is resolved. With the court's decision of injunction in favor of the plaintiff, it was decided to be ready to recognize and protect NFT within the scope of property rights. Shaun Leong, chief counsel of the case and shareholder of Withersworldwide, said that this is the first decision in a commercial dispute where NFTs have been recognized as valuable property worth preserving.

Bored Ape Yacht Club (BAYC), known as Bored Ape, is a collection of NFT (Qualified Intellectual Deeds) built on the Ethereum blockchain. The collection includes profile pictures of algorithmically generated cartoon monkeys.

The plaintiff's NFT, which is the subject of dispute, is BAYC NFT No. 2162.

For more detailed information on the case, you can access the Bloomberg report at https://www.bnnbloomberg.ca/bored-ape-nft-barred-from-sale-by-singapore-court-after-dispute-1.1768376 .

You can reach our article about the copyrights of works of art that have been turned into NFT, from the link.

In this court decision, which includes property rights and copyrights, the issue of NFT secured loans draws attention. With an unexpected decision, Nexo, which is the credit institution in the digital finance sector, announced that it has given an NFT-backed loan of 3 million dollars. According to the news in Bloomberg Technology – Crypto, two 'CryptoPunks Zombies' were used as collateral for NFT-backed loans. The annual interest rate for the 60-day loan from the anonymous borrower who pledged Zombie NFTs as collateral was 21%. The transaction also demonstrates how the financialization of NFTs has evolved since the rise of non-cashable tokens in the crypto markets last year. As another example, we can give the crypto borrower having to give up his NFT, which he showed as collateral on the loan platform NFTfi, due to his inability to pay his loan on time. In terms of the credit platform, it is not a problem that the 12.000 TL loan is not paid on time, on the contrary, it has made a profit. Collateralized as part of the “Art Blocks Curated” set, NFT was valued at $300,000 as its popularity skyrocketed. With the debtor's inability to repay the loan, the NFTfi platform became the owner of a $300,000 NFT collector's item for a $12,000 loan.

We can cite another striking example from the United Kingdom Supreme Court decision. Lavinia Osbourne, the founder of Women in Blockchain Talks, filed a lawsuit demanding injunctive relief to stop the transfers of the NFTs in question, claiming that two of her works from the "Boss Beauties" NFTs collection were stolen via the OpenSea platform. In that case, the UK Supreme Court ruled that NFTs should be considered “properties”. Accordingly, a provision was made to prevent the sale and transfer of NFTs until the end of the litigation process. The court also gave OpenSea time to submit information about the two users who committed the violation to its file. On top of that, the OpenSea platform announced that it had frozen accounts that allegedly transferred NFTs without the owner's consent. The relevant decision of the Supreme Court was also a precedent, considering NFTs as an asset value that can be subject to an injunction and must be legally protected.

Boss Beauties is an NFT collection linked to images of 'beautiful, diverse, empowered women' represented from many different cultures. It is claimed that the NFTs that are the subject of the lawsuit are Boss Beauty 680 and 691.

Our last example will be the case filed by artist Ma Qianli, which was the subject of the Chinese Hangzhou Internet Court's decision dated April 22, 2022. The artist stated that his work, which is a part of his NFT series titled “I am not a chubby tiger” and includes a vaccinated tiger image, was sold for 899 Chinese Yuan by a user on the BigVerse NFT platform under the name “a chubby tiger taking vaccination” without his consent. Thereupon, the plaintiff stated that BigVerse, as the NFT marketplace platform, also received a certain share from this sale, alleging copyright infringement. He demanded that the acts within the scope of the rape be stopped and BigVerse pay 100,000 Chinese Yuan in compensation. The court decided that BigVerse should not act only with the 'notice and takedown' method. It also decided to pay 4,000 Chinese Yuan in compensation and stop the transfer of NFTs, emphasizing the importance of users doing a review before uploading NFTs to the platform and the need for research on authorship prior to uploading. So, NFT platforms need to develop systems that verify entitlement as a marketplace.

As we have seen in the examples, NFTs that are the subject of court decisions are considered within the scope of property rights. This understanding also enables NFTs to be used as collateral in a financial sense. However, the issue that should not be forgotten is the application of regulation technologies (RegTech) for the management of the compliance processes that are becoming more complex in the financial sector. The solution to this complexity in the financial sector is methods such as AML (Anti-Money Laundering), KYC (Know Your Customer), and sanctions list scanning. AML is used for anti-money laundering and KYC is the design definition of 'know your customer'. Anti-Money Laundering (AML) Law Compliance includes detailed customer investigation and monitoring of customer activities, reporting suspicious transactions, and conducting internal audit activities. The Know Your Customer Model and Compliance (KYC) is a profile review such as identifying and verifying customers. In the coming days, it will be very important for Turkey to take necessary actions in case of processes that do not comply with the regulations and suspicious movements for banks, payment institutions and actors in crypto money exchanges subject to MASAK sanctions. Otherwise, there will be both financial and reputational losses for financial institutions.

What's happening in Turkey?

It can be said that the situation in the Turkish cryptocurrency exchange is still uncertain. The regulation on the non-use of crypto assets as a means of payment with the effective date of 30.04.2021 still remains in effect. Payment and electronic money institutions are prohibited from intermediating on platforms that provide trading, custody and transfer services for crypto assets or fund transfers from these platforms. However, the ownership of cryptocurrencies by mining method, wallet to wallet or through exchanges without using these institutions is not within the scope of the ban. Unless the Crypto Asset Law and a new regulation regarding payments made with crypto assets come into force, any legal dispute regarding virtual lands purchased through platforms will not be subject to lawsuits in our country's courts, and legal claims based on virtual lands will not have a counterpart in Turkish legislation.

The management of cryptocurrency exchanges is provided by companies registered in the Turkish Trade Registry, and no inspection, license, or capital adequacy is sought. For this reason, investors suffer from both the loss of value due to market conditions and the collapse of stock markets that do not have strong capital. So much so that it has been only one year since the Thodex haul, which featured famous names and luxury cars in its advertisements and gave 150 Dogecoins to its new members. Although companies such as Thodex and Vebitcoin have created an erosion of confidence in the market, cryptocurrency exchanges remain attractive for Turkish investors due to the reality of exchange rates and inflation. For this reason, some meetings are held in Ankara for the preparation of legislation for the crypto market. As a result of these negotiations, according to the statements made by the actors of the cryptocurrency exchange and the government, it is stated that the aim is not to prohibit but to create a regulatory legal regulation. As a result, it is expected that the current draft will be turned into a law proposal with institutions such as the Ministry of Treasury and Finance, the BRSA, and the SPK, and the final version will be discussed in the parliamentary commissions.

Conclusion

It is generally thought that video games are the only way to experience the metaverse. Virtual reality glasses (VR) may be the first thing that comes to mind when most people think of the metaverse. However, we see that the metaverse is a universe of virtual reality, augmented reality, and video. Therefore, the existence of various devices is not necessary for the experience of virtual worlds. The diversity of this user experience on a sectoral basis is due to the easy and simple access of the players to the activity they want. It is beneficial to quickly integrate the regulations in the world in terms of the situation of electronic wallets and banks in the metaverse remains in place. The transaction volume will expand considerably;

- when the complex structure and transitions in the Metaverse and transitions between different virtual worlds are provided seamlessly,

- when identity and asset transitions are seamless,

- when the necessary network security and common protocols are created,

- when users are using the wallet infrastructure.

When the necessary infrastructure and equipment are provided, wearable technologies will perhaps take us to the seaside and allow us to breathe in the smell of summer. We will follow the developments related to this universe.

* This article has been originally published on Harvard Business Review Türkiye on September 21, 2022. Please click here for the original article in Turkish.